Some Known Incorrect Statements About Mortgage Closing Procedure

transfers possession of your brand-new residence from the vendor to you. Yes, there's a whole lot going on, and also a great deal of money is going to transform hands. But when you understand what to anticipate as well as plan well, it can be a smooth, relatively low-stress experience.

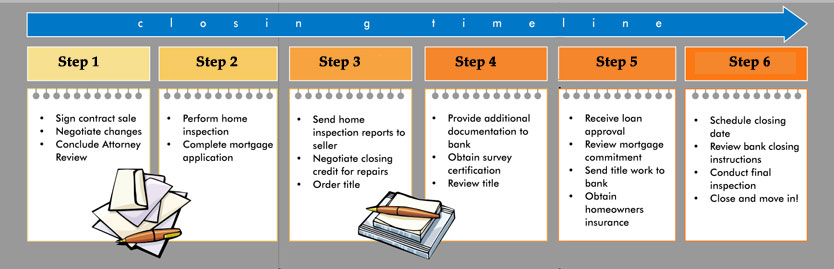

The residence shutting procedure actually starts as quickly as you and also the vendor have actually authorized a purchase arrangement. People usually describe this duration as being "in escrow." What's the timeline? Typically four to 6 weeks. In limited markets, nonetheless, it can be as long as 2 months, because it's more challenging for vendors to collaborate the sale of their residence with buying another.

Closing on a house is a large bargain, yet it could in fact be simpler than finding one that you desire and can pay for to begin with. And when it's over, you entrust to the secrets! As well as a home mortgage. To shut the bargain on your home, you need a closing representative (additionally called a negotiation or escrow agent).

In many states, the closing agent is a neutral 3rd party that helps a negotiation company (commonly called an escrow firm or title company). Occasionally you can pick the company; this is typically discussed with the seller. The standard Car loan Quote develop you obtained after you requested your financing notes the closing services you can look for (see web page 2, area C).

5 Simple Techniques For Action In Shutting A Home Mortgage

Yet others call for one to prepare only particular records, so you end up with both a settlement business and also a property lawyer. Which states need a lawyer for all or component of the procedure? We think twice to give you a checklist, considering that regulations alter constantly. A lot of them are east of the Mississippi.

Where a lawyer is optional, you might want one anyhow. Unless you employ your own lawyer, there's nobody at the closing that exclusively represents your legal interests. If there's anything uncommon regarding the sale, most definitely play it secure as well as employ one. Also the finest realty representative is not a realty lawyer.

Your state bar association may have a lookup. Hourly costs commonly range from $150 to $350. Lenders need you to purchase home owners insurance and bring the plan to the closing. That insurance coverage is pretty important to both you and also them! As you can think of, the expense of insurance differs widely relying on the worth of your home, just how important your stuff is, as well as where you live.

Before you go shopping, have a look at these eight typical mistaken beliefs concerning house owners insurance coverage. When you buy a house, you're getting the "title" to the residential or commercial property, which offers you single, clear ownership. Title insurance policy supplies security in the not likely but possibly devasting event that somebody else, one day, makes a surprise case on the property.

The Ultimate Guide To Mortgage Closing Procedure

The essential thing to understand is that you need your very own plan. Your lending institution will certainly need you to purchase title insurance policy to safeguard their investment, but their policy doesn't cover you. Technically, it's optional for you, but please don't pass on it. Without it, you can shed your house and your entire investment if your title ever before were challenged.

The price of a title insurance coverage varies extensively around the nation. The average has to do with $1,000. You can conserve money by acquiring both policies from the very same firm. Commonly, the lending institution has a favored insurance policy business, but you have the right to choose a various one. Prior to you can close, you need to meet all the problems set by your lending institution.

Some conditions might be details to your funding, yet common ones consist of a clear title record, an evaluation figure that's at least the amount of the loan, paperwork of your earnings, as well as evidence of insurance coverage. If you become concerned concerning satisfying any one of the problems, call your lending policeman ASAP.

Do yourself a favor and also start your arranging, packing, and other tasks early. You'll have enough on your mind on closing day without bothering with discovering more boxes. Here's a sanity-saving eight-week list for you. This important file, a nationally standardized kind, makes a list of the closing costs to both you and also the vendor and lays out key details concerning your car loan.

Top Guidelines Of Action In Closing A Home Loan

The expenses revealed in the Closing Disclosure ought to be comparable to what you saw on the Funding Estimate when you made an application for the car loan. Any type of surprises? Begin asking inquiries. The walk-through is a fast final consider your future house. Your agent will schedule it, preferably for the same day you close.

The bettyjunedzer759.tearosediner.net/everything-about walk-through might be quick, however it isn't simply a rule. Before you take possession of the home, you require to see to it the seller actually has actually vacated and also left points in the problem you accepted. Every representative has stories: vendors that haven't also began packaging, a smashed image window ... If anything is awry, your representative will hop on the phone promptly.

If the seller was intended to do anything major, have the work examined by an expert prior to the walk-through. The closing representative (whether that's a settlement business or your lawyer) will send you a list of everything you require to offer the closing. If you have any type of inquiries, do not think twice to get in touch with the closing representative or your lending institution.

The home mortgage as well as other records are signed, payments are exchanged, and ultimately, the waiting is over: you obtain the tricks. If you have any unanswered questions, this is your last opportunity. You'll be encountering a quite big pile of documents. It's not so poor if you know what's coming, so below's a quick overview to your closing records.

The 25-Second Trick For Action In Closing A Home Loan

If your closing agent is your own lawyer, it will most likely be at their workplace. That will be there? This varies depending on where you live. Your realty agent can inform you what to expect. Often there's an actual crowd, consisting of the closing agent from the settlement business, your lawyer if you have one, the vendor's attorney if they have one, the lending institution's agent, the vendor, as well as both property agents.

You may have the secrets, but you're refrained from doing yet. After you close, it's wise to file a homestead declaration, likewise called a homestead exception. In some states, homestead is automatic, however don't assume. Ask your actual estate representative or closing representative about it. A homestead declaration registers your house with both the federal as well as state federal governments as your key home as well as shields it in different ways.

The details can be a little bit complex, however homestead usually gets you a minimum of 3 kinds of security: If you ever before encounter personal bankruptcy, homestead can help protect against the forced sale of your house to pay debts, besides the home loan (i.e. no help in a foreclosure scenario), construction liens, and also residential property tax obligations Exempts you from a certain amount of building taxes Helps a surviving partner remain in the house To file, call your county assessor's workplace.